Biogas production has been used domestically for decades as a way to manage millions of tons of food, water, and animal waste. Biogas systems recycle waste and produce energy, preventing emissions from entering the atmosphere and nutrients from entering waterways, creating healthier soil, and providing renewable energy. The United States has over 2,000 biogas production sites spread across all 50 states, and several compliance programs provide incentives for renewable natural gas production due to its environmental and energy benefits. Christianson’s team of compliance experts provides verification for renewable natural gas under many of these programs. Continue reading to learn more about biogas and renewable natural gas and how Christianson supports RNG producers by providing verification services for the industry!

What is Biogas?

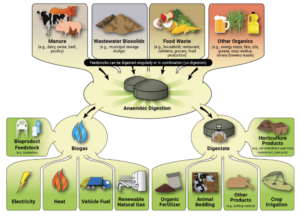

Biogas systems use anaerobic digestion to recycle organic waste into energy and valuable soil products using natural, biological processes. Wasted or spoiled food, animal manure, sewage, byproducts from rendering operations, and fats, oils, and greases can all be used as biogas feedstock. Using anaerobic digestion, microorganisms break down the organic feedstock in the absence of oxygen. This process takes place in a sealed tank or vessel referred to as a reactor and produces biogas and digestate.

Biogas is composed of methane (the primary component of natural gas), carbon dioxide, hydrogen sulfide, water, and trace amounts of other gases. The energy contained in biogas can be used like natural gas, providing heat and electricity. Upgrading – or purifying – raw biogas removes carbon dioxide, hydrogen, water, and other chemical components to produce renewable natural gas (RNG). Once upgraded, RNG can be injected into existing natural gas distribution pipelines or compressed and used as transportation fuel. Some RNG is further processed to generate alternative transportation fuel, energy products, or advanced biochemicals and bioproducts.

The byproducts of biogas production also have beneficial applications that support overall biogas economics as a source of revenue. The remaining solids and liquids can be used in agriculture as fertilizers, compost, and soil amendments. Digestate is also being used as a foundational material in the production of bioplastics.

Flow of feedstocks through anaerobic digestion system to produce biogas, digestate – courtesy U.S. EPA

Biogas and Compliance Programs

Biogas production is incentivized at both the federal and state level, with biogas producers benefiting from both Renewable Identification Credits under the US Renewable Fuel Standard (RFS2) and credits under California’s Low Carbon Fuel Standard (LCFS). Biogas producers can also capture incentives under programs in Oregon and British Columbia, as well as under the anticipated Washington State Clean Fuel Standard. Incentives at the state level – usually through low carbon fuel programs – can be stacked with RIN values assigned under RFS2.

Under the RFS2, RNG which is compressed or liquified for transportation use is characterized as a cellulosic (D3) RIN or an advanced biofuel (D5) RIN. Biogas producers who participate in RFS2 are subject to reporting and verification requirements, much like other renewable fuel producers.

RNG is also incentivized through California’s Low Carbon Fuel Standard as an opt-in fuel where RNG providers earn credits based on their fuel’s carbon intensity (CI). The program includes five Tier 1 Simplified CI Calculators for natural gas and RNG:

- LNG and C-LNG from North American Landfills

- Biomethane from North American Landfills

- Biomethane from Anaerobic Digestion of Wastewater Sludge

- Biomethane from Anaerobic Digestion of Dairy and Swine Manure

- Biomethane from Anaerobic Digestion of Organic Waste

Pathways for RNG derived from manure tend to achieve the lowest CIs under the LCFS in large part due to the credit given for methane reduction. The average CI for LCFS RNG pathways which use manure as a feedstock is -332.95[1]. Compared to manure derived RNG, RNG produced from landfill gas and municipal solid waste have much higher CIs. Landfill gas pathways have an average CI of 55.73, and municipal solid waste pathways have an average CI of 29.53.

California’s LCFS also allows RNG providers to use book-and-claim accounting for pipeline-injected RNG. This regulatory provisions permits RNG’s environmental attributes (GHG reductions) to be decoupled from physical traceability of the RNG, allowing RNG producers to generate credits for gas that is injected into a natural gas pipeline if those environmental benefits can be matched to compressed natural gas dispensed in the California transportation fuel market. A producer’s ability to use book-and-claim accounting depends on the RNG itself as well as its end use and where that end use occurs.

Regulatory Environment

The RNG industry has grown considerably in the last decade, in large part due to the success of California’s LCFS and subsequent legislation being enacted in other states that mimics California’s program. A growing need to reduce and limit methane emissions – especially in agricultural production operations – is also spurring investment and development in the RNG market.

The industry is eagerly awaiting the US EPA’s RFS SET proposal, due later this month. EPA staff have indicated the proposed rule will include regulatory language that establishes RIN generation for electrification – an evolution of RFS2 that RNG producers have been pushing forward for years. The success of the proposed eRIN provisions will depend in part on where RIN generation occurs, and which parties will be allowed to generate RINs. The proposed rule is now in the hands of the Office of Management and Budget (OMB) for review, and EPA’s deadline for publication of the proposed SET rule is November 30.

California’s Air Resources Board (CARB) is moving through its scoping plan process, soliciting feedback from stakeholders on a myriad of proposed changes to the LCFS that will help the state meet its GHG emissions reduction goals. A portion of the proposed changes would affect RNG production and importation, and CARB has recently held workshops that detail these proposed changes[2].

CARB has modeled three scenarios that the agency could use to meet the state’s carbon reduction goals, and two of these three scenarios model a phase-down of avoided methane crediting that currently results in negative CIs for RNG derived from animal manure. Currently, RNG providers can receive credit for avoided methane (only in particular pathways) with a guaranteed initial 10-year crediting period, without an end date. CARB is proposing the removal of certified pathways with avoided methane after 2030 and a phase out of eligibility for existing fuel pathways with avoided methane by 2040. Opponents of these provisions believe these measures will inject uncertainty into the market and dissuade investors from financing and developing new projects.

Additionally, CARB has proposed changes to current book-and-claim provisions. The LCFS currently allows for book-and-claim accounting for RNG injected into a North American natural gas pipeline without a deliverability requirement. In this case, RNG is treated differently than low-CI electricity which does not benefit from the same book-and-claim accounting treatment. CARB has proposed limiting book-and-claim accounting to projects that connect to the Western natural gas network and removing book-and-claim accounting for landfill gas unless it is used to produce hydrogen.

As the RNG industry grows and becomes more complex, Christianson’s compliance experts continue to monitor the regulatory environment to keep ahead of the many changes that could potentially affect our clients.

Verification Services

Christianson’s compliance team provides auditing and verification expertise under various federal and state programs. Our RFS auditors can assist you with your registration and reporting requirements under the RFS2. Christianson has been providing annual RIN attest services to RNG producers for a number of years and we have the expertise to offer this service to anyone who generates, buys, or sells these credits. Additionally, Christianson’s compliance team can provide you with your required verification services under California’s and Oregon’s Low Carbon Fuel Standards. Our firm is readying for verifications under Washington State’s program (scheduled to start in January 2023) and plans to participate as a verification body under Canada’s Clean Fuel Regulations.

We have also been working as an LCFS verification body since the inception of the program and are familiar with all four biogas Tier 1 calculators which include landfill gas, wastewater sludge, dairy & swine manure, and organic waste. We can offer pathway verification and validation for these types. In addition to the pathway support, we are knowledgeable in book-and-claim accounting and can perform the quarterly fuels transaction verification related to the actual LCFS credit transactions.

Let Christianson’s trusted advisors assist you in maintaining compliance in these programs by reaching out to Zachery Hauser or Kari Buttenhoff today! Christianson is the go-to CPA firm for the low carbon economy – call us today to speak to one of our experts. We can find elegant solutions to your complex problems and help you achieve your business goals.

Article Published Nov. 20th, 2022

[1] California Air Resources Board, Current Fuel Pathways, as of Nov. 14, 2022 [2] Public Workshop to Discuss Potential Changes to the Low Carbon Fuel Standard – materials and feedback available at https://ww2.arb.ca.gov/our-work/programs/low-carbon-fuel-standard/lcfs-meetings-and-workshops