On May 22, the House passed its version of the “One Big Beautiful Bill” (OBBB) which included a large section on tax extenders. Last week, the Senate ... Continue Reading

News

Update on New Mexico’s Clean Transportation Fuel Standard (CTFS)

In the spring 2024 legislative session, New Mexico passed a bill for the creation of its own Low Carbon Fuel Standard, setting a program ... Continue Reading

Christianson PLLP Named a 2025 Top Workplace by the Star Tribune

We’re thrilled to announce that Christianson PLLP has been named a 2025 Top Workplace by the Minnesota Star Tribune! This prestigious honor is ... Continue Reading

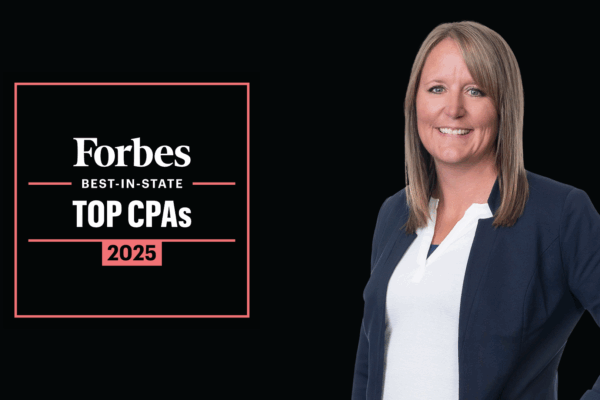

Celebrating Sara DeRoo: A Forbes Best-In-State CPA and Industry Leader

The accounting profession has always relied on visionary leaders who excel in their craft and shape the future of the industry. Sara DeRoo, Partner at ... Continue Reading

Celebrating Our 2025 Scholarship Recipients!

We’re proud to announce the winners of the 2025 Christianson Scholarship for Accounting Students! Congratulations to Jaclyn Dietrich of Osakis Public ... Continue Reading

Claiming the 45Z Tax Credit

How to meet the detailed compliance requirements to claim the 45Z Clean Fuel Production Tax Credit. Kari Buttenhoff, Partner and Danielle ... Continue Reading