The provision from the Tax Cuts & Jobs Act of 2017 which allowed direct expensing of research and development (R&D) costs expired a year ago on December 31, 2021.

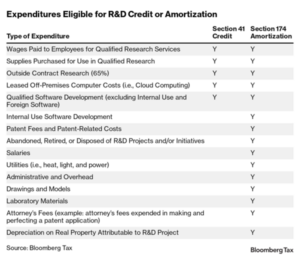

The Internal Revenue Code (IRC) now reverts back to §174, which requires the capitalization of all costs, direct and indirect, related to research, experimentation, and development, regardless of if the costs would normally qualify for the research and development tax credit under IRC §41. Any U.S. sourced costs capitalized may be amortization over a 5-year period (15-years for international sourced costs), with a half year of amortization taken in the year of capitalization.

This has been an area of concern for numerous businesses, especially those in the manufacturing industry where R&D is heavily invested in. Congress, at a bipartisan level, has acknowledged the expiration of the provision needs to be addressed, along with other soon to expire provisions, like 100% bonus depreciation expensing, to keep U.S. investments in innovation moving forward. Although there is much discussion, a divided Congress is struggling to find a bill to include the provision extensions in. Ideas have been floated to attach it to the Farm bill or FFA bill, both expiring September 30, 2023, others have proposed using it as a negotiation on deals increasing the debt limit. An area to keep a close eye on.

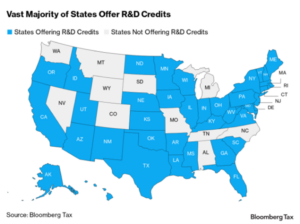

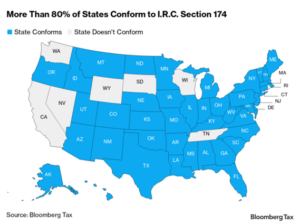

This expired provision not only has an affect at the Federal level, but a majority of the states follow the Federal capitalization rules as well. The good news is, many of the conforming states also have their own version of the Federal R&D credit, which can help offset the increase in tax from the capitalization.

Clients with R&D costs like those listed above are asked to reach out for help analyzing their situations. We have been advising clients with these types of costs to consider filing an extension moving the required filing of the return to September 15, 2023, closer to the time where we may know if the direct expensing provision will be extended or not.