We are closing in on the 180-day claim period for the 2017 Biodiesel and Alternative Fuel Incentives so we wanted to add transparency to those dates and what you need to know.

The IRS has recently issued Notice 2018-21 which provides rules claimants must follow to make a one-time claim for payment of the credits and payments allowable under Sec. 6426(c), 6426(d), and 6427(e) of the Internal Revenue Code for biodiesel mixtures and alternative fuels sold or used during calendar year 2017. These incentives had expired as of December 31, 2016, but were retroactively extended through December 31, 2017 as part of a bill that was passed on February 9, 2018.

Claimants that filed “protective” or anticipatory claims during 2017 for biodiesel and alternative fuel incentives should refile their claims pursuant to the procedures described below. The IRS will not treat as filed any such claims previously filed with the IRS that are not timely supplemented in accordance with the following procedures.

Claim Period and Due Date for Biodiesel and Alternative Fuel Incentives:

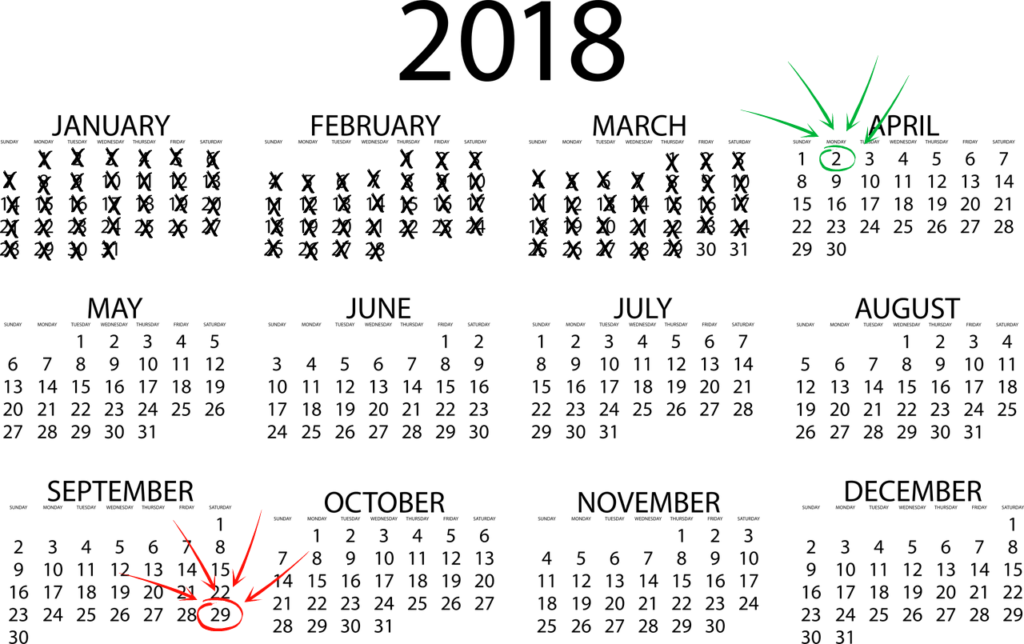

The 180-day claim period for 2017 incentives begins on April 2, 2018.

The 180-day claim period for 2017 incentives begins on April 2, 2018.- All claims for 2017 biodiesel and alternative fuel incentives must be filed on or before September 29, 2018. The IRS will not process claims filed after that date.

- The IRS will deem any claim that is submitted by the method prescribed in the notice before April 2, 2018, as filed on April 2, 2018.

- If the IRS does not pay a 2017 claim that conforms to the notice within 60 days after the claim is received, the IRS will pay the claim with interest from the claim filing date.

Claim Period and Due Date for Alternative Fuel Mixture Credits:

- The claim period for the 2017 alternative fuel mixture credit begins on April 2, 2018.

- The IRS will deem any claim that is submitted by the method prescribed in this notice before April 2, 2018, as filed on April 2, 2018.

- Generally, claims for the Sec. 6426(e) credit must be made within three years from the time the return was filed or two years from the time the tax was paid, whichever is later.

If you have questions about whether you qualify for these credits, how to file, or what the impact of this credit will be, please don’t hesitate to contact one of our experts today!

[button_1 text=”Contact%20Christianson%20Today!” text_size=”15″ text_color=”#ffffff” text_font=”Lato;google” text_letter_spacing=”1″ subtext_panel=”N” text_shadow_panel=”N” styling_width=”30″ styling_height=”20″ styling_border_color=”#ffffff” styling_border_size=”5″ styling_border_radius=”23″ styling_border_opacity=”100″ styling_gradient_start_color=”#1b335d” styling_gradient_end_color=”#1b335d” drop_shadow_panel=”N” inset_shadow_panel=”N” align=”center” href=”https://www.christiansoncpa.com/contact-us/”/]