On December 15th, Minnesota state legislature approved a second round of funding intended to provide financial aid to businesses and nonprofits that have been impacted by an executive order related to COVID-19 that either forced businesses to shut down, or to modify their ability to generate revenue. Below you will find a high-level summary of the bill however it’s recommended that you contact the MN DOR or your accounting professional to learn more about how this bill impacts you.

The bill can be found on the Minnesota Legislature website, but is described as: economic relief provided for businesses adversely affected by the pandemic, business relief payments authorized, regulatory fee waivers provided, additional unemployment insurance benefits provided, movie theater and convention center grants provided, county relief grants provided, deadline application extended for free or reduced-price lunch for the fall 2020 count of eligible students, federal fund replacement provided, reports required, money transferred, and money appropriated.

There are several topics covered by H.F. 45 but for this publication, we will focus on:

- Business Relief Payments

- Unemployment Insurance Benefits

- Movie Theater and Convention Center Grants

- County Relief Grants

How Much Business Relief Funding is Available and Who Qualifies?

H.F. 45 makes $88 million available for business relief payments that will be administered by the Minnesota Department of Revenue with payments ranging from $10,000 to $45,000.

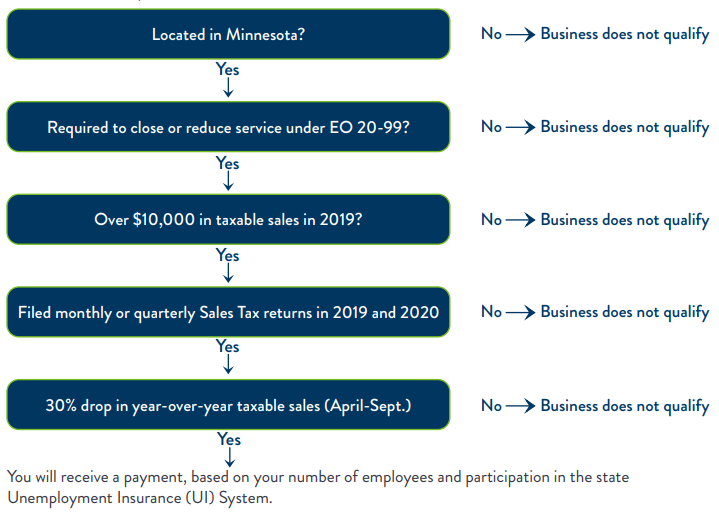

If you were forced to close to the public due to Executive Order 20-99, you may be eligible for this funding. This applies to businesses who were registered as a business as of November 1, 2020. The graphic below will help you determine your eligibility.

You can read the full list of eligibility requirements here. This $88 million appropriation will expire on March 15, 2021. If you qualify, you should see payment in January 2021. Contact your tax advisor to assist with questions about this program.

You can read the full list of eligibility requirements here. This $88 million appropriation will expire on March 15, 2021. If you qualify, you should see payment in January 2021. Contact your tax advisor to assist with questions about this program.

Additional Unemployment Insurance Benefits

This bill added up to 13 weeks of “special additional unemployment benefits” from December 27, 2020, to April 10, 2021, to applicants who have exhausted all other available state and federal unemployment benefits. To qualify, the applicant must meet regular unemployment eligibility requirements. Please note that these unemployment benefits are taxable to the employee.

Movie Theater and Convention Center Grants

Minnesota Convention Center Relief Grant Program – This temporary program was established to provide economic relief for convention centers adversely affected by the COVID-19 pandemic. This program will make grants of up to $500,000 to eligible convention centers located in Minnesota. DEED will administer this program. All convention centers interested in receiving a relief grant must submit a completed application by Jan. 29. Applications are available through January 29th, 2021 here.

Minnesota Movie Theater Relief Grant Program – This temporary program was established to provide economic relief for movie theaters adversely affected by the COVID-19 pandemic. This program will make grants of up to $150,000 to eligible movie theaters located in Minnesota. DEED will administer this program. All movie theaters interested in receiving a relief grant must submit a completed application by Jan. 29. Applications are available through January 29th, 2021 here.

County Relief Grants

County Relief Grants provide a onetime $114.8 million appropriation from the general fund to the commissioner of management and budget for payments to counties for relief grants to local businesses and nonprofits. You can see the complete list of Minnesota counties and their allocated funds and find more information here. If you have questions, please contact us.

This bill only appropriates these funds until March 15, 2021 so we recommend that you act fast. Contact our experts today with questions.

[button_1 text=”Contact%20Christianson%20Today!” text_size=”15″ text_color=”#ffffff” text_font=”Lato;google” text_letter_spacing=”1″ subtext_panel=”N” text_shadow_panel=”N” styling_width=”30″ styling_height=”20″ styling_border_color=”#ffffff” styling_border_size=”5″ styling_border_radius=”23″ styling_border_opacity=”100″ styling_gradient_start_color=”#1b335d” styling_gradient_end_color=”#1b335d” drop_shadow_panel=”N” inset_shadow_panel=”N” align=”center” href=”https://www.christiansoncpa.com/contact-us/”/]Click here to subscribe to our newsletter where we bring you the latest information that may impact you and/or your business.