Renewable fuel producers may be excited about using the 45Z Clean Fuel Production Credit, might overlook a valuable option—reducing their facility’s ... Continue Reading

Tax

Unlocking the Full Potential of the 45Z Tax Credit: Navigating Prevailing Wage and Apprenticeship Requirements

The 45Z Clean Fuel Production Tax Credit offers renewable fuel producers a powerful financial incentive for reducing greenhouse gas emissions, with ... Continue Reading

Navigating What The OBBBA Means for Businesses

The "One Big Beautiful Bill Act" (OBBBA) introduces several important tax changes for businesses starting in 2025. Here’s a simplified summary of the ... Continue Reading

How the 2025 OBBBA Rewrites the Rules for Individual Taxpayers

The "One Big Beautiful Bill Act" (OBBBA), signed into law on July 4, 2025, represents the most sweeping overhaul of the U.S. tax code since the 2017 ... Continue Reading

What Individuals Need to Know About the “One Big Beautiful Bill”

On May 22, the House passed its version of the “One Big Beautiful Bill” (OBBB) which included a large section on tax extenders. Last week, the Senate ... Continue Reading

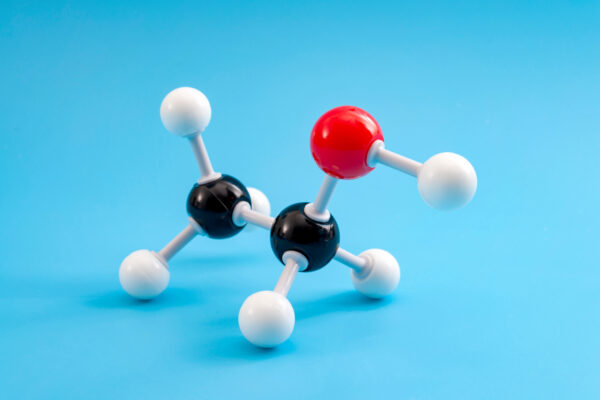

Claiming the 45Z Tax Credit

How to meet the detailed compliance requirements to claim the 45Z Clean Fuel Production Tax Credit. Kari Buttenhoff, Partner and Danielle ... Continue Reading